Foreign Exchange refers to the currency of foreign countries. There is a demand for the currencies of other countries due to reasons like international trade in goods and services, economy strength and other factors. The demand and supply requirements of the different currencies worldwide is the reason which affects their prices vis-à-vis other currencies. To regulate the prices better and centralize market (demand and supply) action, there are Forex exchanges where people can trade currency.

The currencies are represented by their symbols as C1/C2, where C1 and C2 are the currencies. For example, USD/EUR will mean the rate of 1 USD in terms of "n" Euros. The pairs of currencies are called by various names like majors, crosses and exotics. Majors are the currency pairs of Euro, Yen, Pound, Swiss Franc, Canadian dollar and Australian dollar with US dollar. "Crosses" are those currencies of the developed world which are not pitted against the dollar. Exotics are the currency pairs of developing economies with those of other developing or developed economies.

In FX trading jargon, the ask price is the selling price of the currency by the broker and the "bid" price is the buying rate by that broker. Whenever you go to a bank, you will find two rates of currencies on digital board. The higher one is the selling rate for the bank, meaning that you will be required to pay higher amount for buying that currency. The lower amount is the buying rate, meaning that the bank will buy at a lower rate than selling rate. In currency trading, the spread is the difference between ask and bid rate.

Spot, Forward And Contracts For Difference (Cfds)

Spot price of a currency is the current Forex trading rate. If you place the spot order, the currency will be bought or sold at the rate prevailing at the time of placing the order. If you think that the currency trading rate will change in the future and you want security against fluctuation, then you fix a rate and promise to buy or sell the currency on a future date at that very price. This is a forward contract.

Forex CFDs are different to buying currencies at a bank, where you don't physically own the currency you buy. Rather, they anticipate future movements and take a position in CFD trading accordingly so as to make profit from the difference of the current and future exchange rate on their booked position. Apart from the CFDs, there are other derivatives of different types which are meant for hedging or risk covering purposes like the futures and options. These are based on underlying security or assets called derivatives.

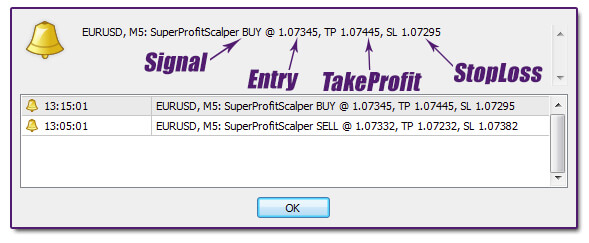

Forex trading platforms are generally provided online by a number of duly registered and licensed companies using special software. They allow ease and convenience of trading, enlarges the customer base and volume of business and also makes the market more liquid.

The customers use a number of charts to analyze the market movements and accordingly take their positions and enter into different types of contracts.

About the Author

Article Written By: ailicef

1- The Basics Of Currency Trading By Tim Parker - Investopedia

The investment markets can quickly take the money of investors who believe that trading is easy. Trading in any investment market is exceedingly difficult, but success first comes with education and practice. So, what is currency trading and is it right for you?...

Read more

2- Understanding The Basic Elements of Forex Trading - Business Insider

The foreign exchange market is finally beginning to garner mainstream attention. The Bank of International Settlements estimates that the average daily volume in the fx market is around $4 trillion, which makes it by far the largest financial marketplace in the world. Surprisingly, however, many novice investors and traders have never even heard of this market...

Read More

3- Forex Trading Tutorial - Oanda.com

Currency Trade, Forex Trade, FX Trade – these are all terms used to describe the exchanging of one currency for another; for example, the exchanging of U.S. Dollars to British Pounds. In the foreign exchange market, this is viewed as buying pounds while simultaneously selling dollars*. Because two currencies are always involved, currencies are traded in the form of currency pairs, with the pricing based on the exchange rate offered by dealers in forex trading market...

Read More

More Articles:

1- The Basics Of Currency Trading By Tim Parker - Investopedia

The investment markets can quickly take the money of investors who believe that trading is easy. Trading in any investment market is exceedingly difficult, but success first comes with education and practice. So, what is currency trading and is it right for you?...

Read more

2- Understanding The Basic Elements of Forex Trading - Business Insider

The foreign exchange market is finally beginning to garner mainstream attention. The Bank of International Settlements estimates that the average daily volume in the fx market is around $4 trillion, which makes it by far the largest financial marketplace in the world. Surprisingly, however, many novice investors and traders have never even heard of this market...

Read More

3- Forex Trading Tutorial - Oanda.com

Currency Trade, Forex Trade, FX Trade – these are all terms used to describe the exchanging of one currency for another; for example, the exchanging of U.S. Dollars to British Pounds. In the foreign exchange market, this is viewed as buying pounds while simultaneously selling dollars*. Because two currencies are always involved, currencies are traded in the form of currency pairs, with the pricing based on the exchange rate offered by dealers in forex trading market...

Read More